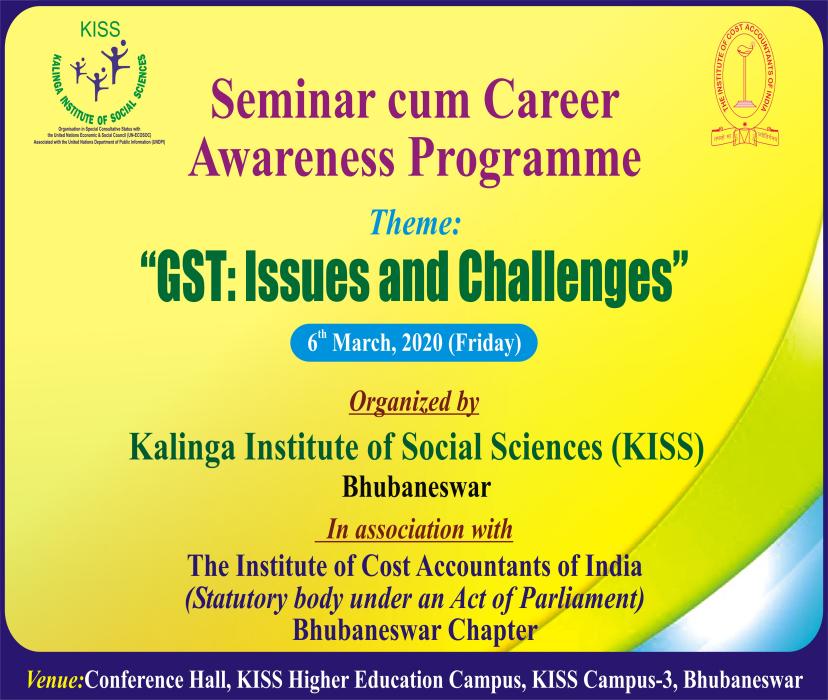

On Friday, the 06th March 2020 a Seminar cum Career Awareness Programme was organized by School of Tribal Resource Management, Kalinga Institute of Social Sciences (KISS) , Deemed to be University, Bhubaneswar in association with The Institute of Cost Accountants of India, Bhubaneswar Chapter on the theme “GST: Issues and Challenges” in the conference hall of KISS Higher Education Campus, Bhubaneswar.

The seminar was chaired by Chief Guest Prof. H. K. Satpathy, Vice-chancellor, Kalinga Institute of Social Sciences (KISS) , Deemed to be University, co-Chaired by Dr. Snigdharani Panda, Associate Dean, School of Resource Management, KISS Deemed to be University, Dr. Chittaranjan Bhoi, Vice-Principal, Kalinga Institute of Social Sciences (KISS). Eminent Resource Person CMA Subhasish Sahoo, Director of Canny Services Ltd., and Shri Hemant Kumar Biswal, Assistant Administratitive Officer (AAO), The Institute of Cost Accountants of India, Bhubaneswar Chapter also graced the occasion.

About 200 of students from Undergraduate and PG participated in the career awareness programme. While Dr. Snigdharani Panda, Associate Dean, School of Tribal Resource Management, coordinated the proceedings along with Mr. Udayana Mohanty,KISS, Ms Namaswani Das, faculty of STRM did the anchoring. All the members of faculty from the Commerce and Economics departments attended the programme..

Prof. H.K.Satpathy, in his introductory speech, pointed out the far reaching impact of GST on Indian economy, trade and commerce. He gave a proposal to the office bearers of ICAI to design a short-term orientation programme, like a Certificate Course, on GST specifically for the students of Arts, Science and Commerce streams who are generally not as conversant on Taxation as the students of Commerce stream. He was of the opinion that such a knowledge-upgrading capsule course would enhance the employability prospects in the corporate sector for the students of non-Commerce areas.

CMA Subhasish Sahoo explained the applicability and implications of various provisions of GST on different products and services. He took many questions from the students and lucidly explained to them on the innovative features of GST and how they were going to unfold a win win situation for all the stake holders, like the produces, consumers, tax-administrators and the government.

Mr. H. K. Biswal invited attention of the students to the curriculum and pedagogy patterns designed by ICAI for students desirous of making a professional career in Finance and Taxation. The layout begins with basic foundation courses and goes gradually on to advanced courses.

The seminar concluded with Dr. Chita Ranjan Bhoi, Vice-Principal, KISS giving a vote of thanks to the Vice-chancellor, all the student- participants , resource persons and the members of faculty.